●Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Q2. Outline India’s position regarding recent tensions in the Middle East and discuss potential economic implications amid regional unrest.

Iran’s recent attack on Israel has heightened tensions not only in the Middle East but also globally. India, maintaining friendly relations with both nations, has voiced “serious concerns” regarding the potential escalation of hostilities. The situation has also raised apprehensions among regional traders and could unsettle markets.

I. India’s Position on Recent Middle East Tensions:

A. Diplomatic stance

●Maintaining neutrality and advocating for peaceful resolution.

●Engaging in diplomatic dialogues and multilateral forums to address the tensions.

B. Statements from government officials

●Official statements from the Ministry of External Affairs expressing concerns over the escalation of tensions.

●Calls for dialogue and de-escalation from Indian leaders.

C. Efforts towards mediation or resolution

●Participating in international efforts aimed at easing tensions, such as diplomatic initiatives or peace talks.

●Offering diplomatic support for regional actors involved in conflict resolution efforts.

India-Israel trade:

●Since establishing diplomatic relations in 1992, India and Israel have witnessed a significant uptrend in trade, initially dominated by diamond transactions, escalating to $10.7 billion (excluding defence) in the fiscal year 2022-23.

●Notably, trade doubled in the past four years, surging from $5.56 billion in 2018-19 to $10.7 billion in 2022-23.

●Between 2021-22, India’s exports to Israel amounted to $8.45 billion, with imports standing at $2.3 billion, resulting in a trade surplus of $6.13 billion in India’s favour.

●According to the Ministry of External Affairs’ (MEA) brief on foreign relations, India is Israel’s second largest trading partner in Asia and the seventh largest globally.

India-Iran trade:

●In the fiscal year 2022-23, Iran ranked as India’s 59th largest trading partner, with bilateral trade amounting to $2.33 billion.

●Despite a recent upturn, trade with Iran had seen a decline in previous years due to US sanctions on Tehran, plummeting from $17 billion in 2018-19 to $2.11 billion in 2020-21.

●India mainly exported agricultural goods and livestock products to Iran, while importing items like methyl alcohol and petroleum bitumen.

●In terms of Foreign Direct Investment (FDI), Israel accounts for only 0.4% of India’s total inflows, with Indian firms investing more in Israel than vice versa.

●India is also involved in infrastructure development at the Shahid Beheshti Port in Iran to enhance connectivity with the Middle East and Central Asia, receiving minimal FDI from Iran.

II. Potential Economic Implications Amid Regional Unrest:

●Unlikely rise in petrol prices in India due to Middle East tensions.

●Potential impact from Red Sea tensions on trade routes crucial for global trade.

●Yemen-based Houthis’ actions targeting ships since November 2023.

●Conflict between Iran and Israel exacerbating India’s trade issues.

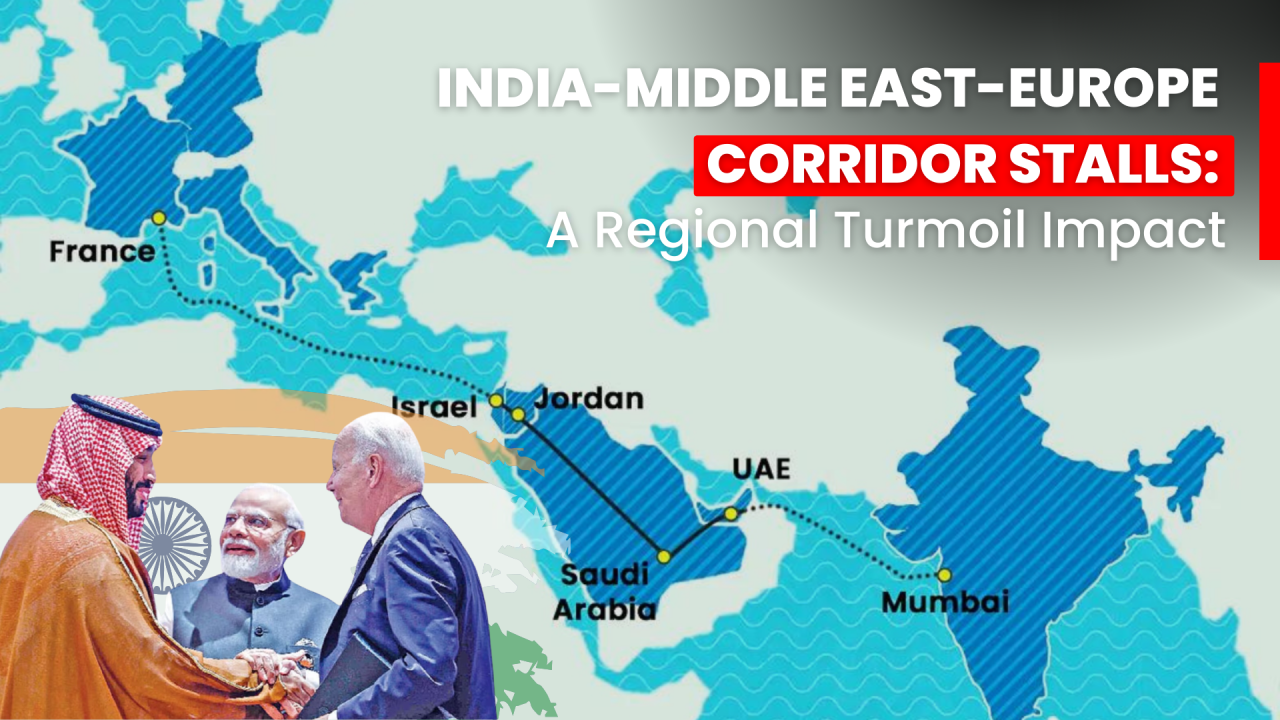

●Instability in West Asia could stall projects like the India-Middle East-Europe Economic Corridor.

A. Trade and energy dependency

●India’s reliance on Middle Eastern countries for oil imports and its impact on trade relations.

●Disruption of trade routes and supply chains due to heightened tensions.

B. Impact on oil prices and energy security

●Fluctuations in global oil prices affecting India’s energy security and economic stability.

●Measures taken by India to mitigate risks, such as diversifying energy sources and strategic oil reserves.

C. Investment and business relations

●Uncertainty leading to hesitation among Indian companies to invest in the region.

●Potential disruptions to existing business ventures and contracts.

D. Effects on Indian expatriates and remittances

●Safety concerns for Indian expatriates working in Middle Eastern countries.

●Impact on remittance flows, which contribute significantly to India’s economy.

E. Security concerns affecting tourism and foreign investment

●Security threats deter tourists from visiting the region, affecting India’s tourism industry.

●Decreased foreign investment due to heightened instability and security risks in the Middle East.

Wayforward: While the conflict is not expected to heavily affect oil and gas production, shipping disruptions in the Red Sea could increase prices. India may mitigate consumer impact by considering tax reductions.

Source Indian express

https://indianexpress.com/article/explained/explained-economics/india-israel-iran-trade-oil-prices-tensions-9277472/