1.Analyze the potential benefits and challenges associated with India’s Carbon Credit Trading Scheme (CCTS).

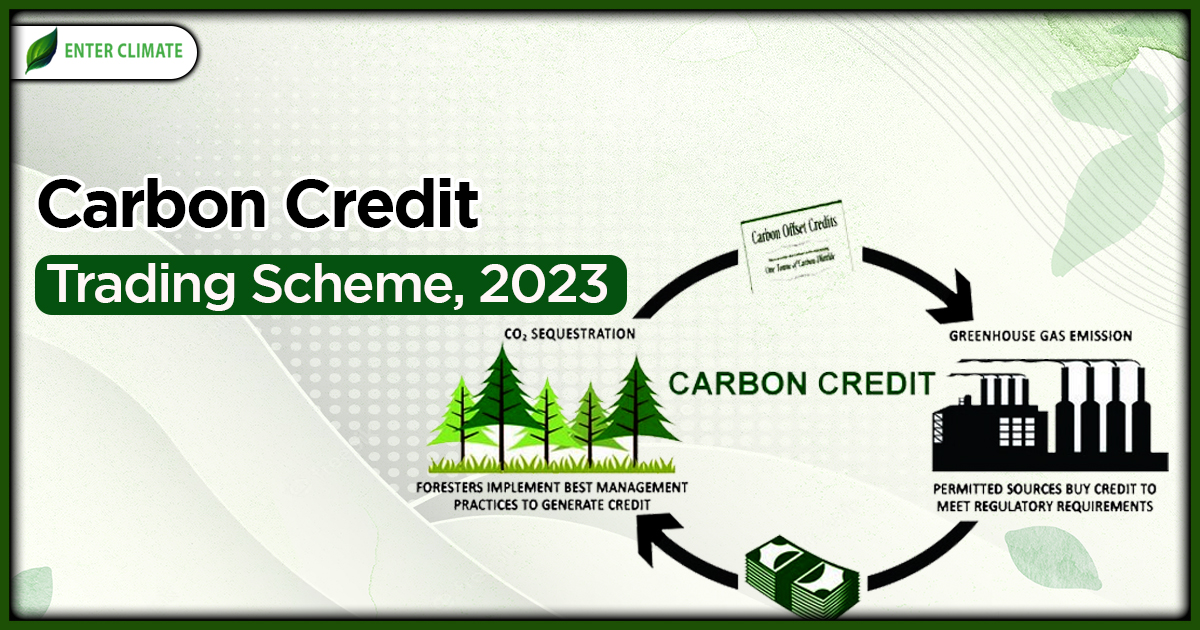

As a part of Nationally Determined Contributions (NDCs) under the Paris Agreement, India’s Carbon Credit Trading Scheme (CCTS) is designed to create a domestic carbon market to incentivize emission reductions and support the transition to a low-carbon economy.

Potential Benefits of India’s Carbon Credit Trading Scheme (CCTS)

- Incentivizes Emission Reductions: The CCTS can incentivize industries and organizations to adopt cleaner technologies and practices by rewarding them with carbon credits for reducing their emissions.

- Promotes Renewable Energy: The scheme can encourage investments in renewable energy sources like solar, wind, and hydro power, which have lower carbon footprints.

- Enhances Energy Efficiency: By rewarding energy-efficient practices, the CCTS can help reduce overall energy consumption and associated emissions.

- New Economic Opportunities: The CCTS can create new economic opportunities in sectors like renewable energy, energy efficiency, and carbon project development.

- Job Creation: The growth of these sectors can lead to the creation of new jobs, especially in rural and semi-urban areas.

- Attracting Foreign Investment: A well-designed CCTS can attract foreign investment in clean technologies and sustainable projects.

- Stimulates Innovation: The CCTS can encourage innovation in clean technologies and sustainable practices by providing financial incentives for developing and adopting new solutions.

- Knowledge Transfer: The scheme can facilitate the transfer of technology and knowledge from developed to developing countries, helping India leapfrog in clean technology adoption.

Potential Challenges of India’s CCTS

- Questionable Carbon Credits: There is a risk of projects claiming carbon credits for actions that would have happened anyway, or for activities that have limited environmental impact.

- Lack of Rigorous Verification: If verification processes are not stringent, it could lead to the issuance of low-quality or fraudulent carbon credits.

- Complex Regulations: Implementing a CCTS requires a complex regulatory framework, which can be challenging to design and enforce.

- Administrative Costs: The administrative costs associated with setting up and managing the CCTS can be significant.

- Potential for Negative Impacts: If not well-designed, the CCTS could lead to unintended negative social and environmental impacts, such as land-use change or displacement of communities.

- Need for Strong Safeguards: Strong safeguards and monitoring mechanisms are necessary to mitigate these risks.

- Global Standards and Regulations: India’s CCTS needs to be aligned with international standards and regulations to facilitate the trading of carbon credits in global markets.

- Negotiating International Agreements: Engaging in international negotiations on carbon markets can be complex and time-consuming.

Way forward:

To successfully implement the CCTS, India needs to address these challenges by:

● Establishing robust verification and monitoring systems.

● Promoting transparency and accountability.

● Ensuring social and environmental safeguards.

● Collaborating with international partners to develop harmonized standards.

India can harness the potential benefits of the CCTS to achieve its climate goals and drive sustainable economic growth.

PYQ

Q. What are the key features of the National Clean Air Programme (NCAP) initiated by the Government of India? [250 Words] [15 Marks] [2020]

SOURCE: