1. Which among the following are the recommendations of the 16th Finance Commission?

1. It has recommended the share of states in the divisible pool of central taxes at 41%.

2. It has recommended that the Centre should bring down the fiscal deficit to 3.5% of GDP by 2030-31.

3. It recommended the annual fiscal deficit limit for states to be 3% of GSDP.

4. It also recommended strictly discontinuing the practice of off-budget borrowings for states.

Select the correct answer using the code given below:

(a) 1, 2 and 4 only

(b) 1, 3 and 4 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

Answer: (d) 1, 2, 3 and 4

Explanation:

In NEWS: The Report of the 16th Finance Commission (Chair: Dr. Arvind Panagariya) was tabled in Parliament on February 1, 2026. The recommendations will apply for the five-year period between 2026-27 and 2030-31.

Key recommendations of the Commission include:

Share of states in central taxes:

- The 16th Commission (FC) has recommended the share of states in the divisible pool of central taxes at 41%. Hence statement 1 is correct.

- Divisible pool is arrived at after excluding cost of collection and cesses and surcharges from the gross tax revenue collected by the central government.

- The share remains unchanged from the 15th Finance Commission award period (2021-26).

Devolution Criteria:

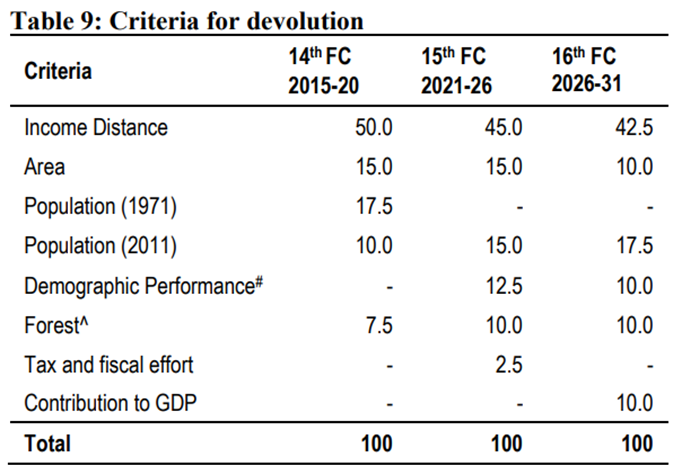

- To determine distribution of central taxes among states, the Finance Commissions come up with a formula with weightage for certain parameters. The 16th FC has given the highest weightage to income distance (Table 9).

- Income distance is the distance of a state’s per capita GSDP from the state with the highest per capita GSDP.

- On this parameter, a state with lower per capita GSDP will have a higher share in devolution to maintain equity among states. The 15th FC had also used this criterion with a comparatively higher weightage.

- The 16th FC has introduced a new parameter which accounts for the contribution to national GDP. This replaces the tax and fiscal efforts parameter used by the 15th FC which rewarded states with a higher tax collection efficiency. Contribution to GDP has also been given a comparatively higher weightage.

- Other parameters include population, area, and forest cover. These parameters are similar to the 15th FC. Weightage for area has been reduced.

Grants-in-aid:

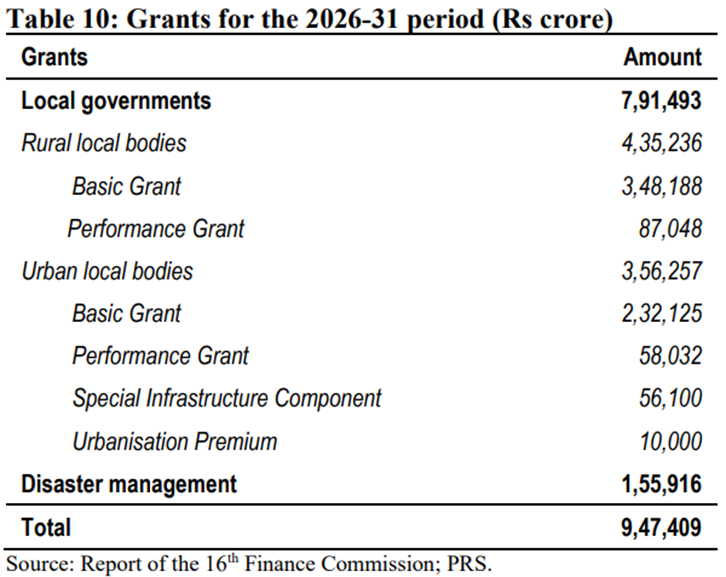

- The 16th FC has recommended grants worth Rs 9.47 lakh crore over the five-year period. These comprise grants for:

- (i) urban and rural local bodies, and

- (ii) disaster management.

- The 16th FC has discontinued the following grants recommended by the 15th FC:

- (i) revenue deficit grants,

- (ii) sector-specific grants for education, justice, statistics, and agriculture, and

- (iii) state specific grants.

- A certain percentage of grants to local bodies will be performance-linked with an aim to incentivise growth in revenue from own sources.

- A special infrastructure component aims to facilitate interventions in comprehensive wastewater management.

- Urbanisation premium is aimed at incentivising rural to urban transition.

Fiscal roadmap:

- The 16th FC has recommended that the Centre should bring down the fiscal deficit to 3.5% of GDP by 2030-31. Hence statement 2 is correct.

- It recommended the annual fiscal deficit limit for states to be 3% of GSDP. Hence statement 3 is correct.

- It also recommended strictly discontinuing the practice of off-budget borrowings for states and bringing all such borrowings onto their budgets. Hence statement 4 is correct.

- The definition of fiscal deficit and debt should be expanded to uniformly include all off‑budget borrowings.

| PYQ REFERENCE: (2025) Q. Which of the following statements with regard to recommendations of the 15th Finance Commission of India are correct? I. It has recommended grants of Rs 4,800 crores from the year 2022-23 to the year 2025-26 for incentivizing States to enhance educational outcomes. II. 45 % of the net proceeds of Union taxes are to be shared with States. III. 45,000 crores are to be kept as performance-based incentive for all States for carrying out agricultural reforms. IV. It reintroduced tax effort criteria to reward fiscal performance. Select the correct answer using the code given below. (a) I, II and III (b) I, II and IV (c) I, III and IV (d) II, III and IV |

Source: https://prsindia.org/files/budget/budget_parliament/2026/Union_Budget_Analysis-2026-27.pdf

2. Consider the following statements with respect to Classical Languages in India:

I. As of October 2024, there are 11 recognized classical Languages in India.

II. As per the Census of India 2011, the top five most spoken languages in the country are classical languages.

Which of the statements given above are correct?

(a) I only

(b) II only

(c) Both I and I

(d) Neither I nor II

Answer: (a) I only

Explanation:

In NEWS: Information given by Union Minister for Culture and Tourism Shri Gajendra Singh Shekhawat in a written reply in Lok Sabha

Government of India recognized the following eleven languages as the Classical Language:

Hence statement I is correct.

| Sl. No. | Classical Language | Date of Recognition |

| i. | Tamil | 12.10.2004 |

| ii. | Sanskrit | 25.11.2005 |

| iii. | Telugu | 31.10.2008 |

| iv. | Kannada | 31.10.2008 |

| v. | Malayalam | 08.08.2013 |

| vi. | Odia | 01.03.2014 |

| vii. | Marathi | 04.10.2024 |

| viii. | Assamese | 04.10.2024 |

| ix. | Bangla | 04.10.2024 |

| x. | Pali | 04.10.2024 |

| xi. | Prakrit | 04.10.2024 |

As per the Census of India 2011, (Office of the Registrar General & Census Commissioner, India). Estimate number of people in India speaking 9 classical languages are as follows:

| Sl. No | Language | Number of People speaking (Approximately in Lakh) |

| 1. | Tamil | 690 |

| 2. | Kannada | 437 |

| 3 | Telugu | 811 |

| 4. | Sanskrit | 0.24 |

| 5. | Malayalam | 348 |

| 6. | Odia | 375 |

| 7. | Marathi | 830 |

| 8. | Assamese | 153 |

| 9. | Bengali | 972 |

It is estimated that part of 1038 Lakh population of Bihar speak in Pali.

As per the Census of India 2011, (Office of the Registrar General & Census Commissioner, India), the top five most spoken languages in the country are as follows:

I. Hindi Hence statement II is incorrect.

II. Bengali

III. Marathi

IV. Telugu

V.Tamil

| PYQ REFERENCE: (2024) Q. The Constitution (71st Amendment) Act, 1992 amends the Eighth Schedule to the Constitution to include which of the following languages? 1. Konkani 2. Manipuri 3. Nepali 4. Maithilis Select the correct answer using the code given below: (a) 1, 2 and 3 (b) 1, 2 and 4 (c) 1, 3 and 4 (d) 2, 3 and 4 |

Source: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2222111®=3&lang=1

3. Which of the following statements best describes the Bio-RIDE initiative?

(a) A centrally sponsored scheme aimed at promoting digital health infrastructure through public–private partnerships.

(b) A Union Cabinet approved initiative to strengthen biotechnology research, innovation, entrepreneurship, and sustainable biomanufacturing.

(c) A mission-mode programme exclusively focused on agricultural biotechnology and genetic modification of crops.

(d) A regulatory framework for biosafety and ethical approval of biotechnology research in India.

Answer: (b) A Union Cabinet approved initiative to strengthen biotechnology research, innovation, entrepreneurship, and sustainable biomanufacturing.

Explanation:

In NEWS: Transforming India into a Global Biopharma Hub

Bio-RIDE:

- The Biotechnology Research Innovation and Entrepreneurship Development (Bio-RIDE) scheme, approved by the Union Cabinet, is a ₹9,197 crore initiative for 2021-22 to 2025-26 designed to boost India’s bioeconomy, targeting $300 billion by 2030.

- It promotes cutting-edge R&D, innovation, and entrepreneurship, specifically supporting sustainable biomanufacturing and biofoundry to address healthcare, agriculture, and environmental challenges. Hence option (b) is correct.

The scheme has three broad components:

a) Biotechnology Research and Development (R&D);

b) Industrial & Entrepreneurship Development (I&ED)

c) Biomanufacturing and Biofoundry

Implementation of Bio-RIDE Scheme will

- Promote Bio-Entrepreneurship: Bio-RIDE will nurture a thriving ecosystem for startups by providing seed funding, incubation support, and mentorship to bio-entrepreneurs.

- Advance Innovation: The scheme will offer grants and incentives for cutting-edge research and development in areas like synthetic biology, biopharmaceuticals, bioenergy, and bioplastics.

- Facilitate Industry-Academia Collaboration: Bio-RIDE will create synergies between academic institutions, research organizations, and industry to accelerate the commercialization of bio-based products and technologies.

- Encourage Sustainable Biomanufacturing: A significant focus will be placed on promoting environmentally sustainable practices in biomanufacturing, aligned with India’s green goals.

- Support researchers through Extramural funding: Bio-RIDE will play a critical role in advancing scientific research, innovation, and technological development across diverse fields of biotechnology by supporting extramural funding to research institutions, universities, and individual researchers in areas such as agriculture, healthcare, bioenergy, and environmental sustainability.

- Nurturing Human Resource in Biotechnology sector: Bio-RIDE will provide holistic development and support to students, young researchers and scientists working in the multidisciplinary areas of Biotechnology. The integrated programme of Human Resource Development will contribute towards the capacity building and skilling of the manpower and make them competent to leverage the newer horizon of technological advancements.

- Further, to enable Circular-Bioeconomy in the country a component on Biomanufacturing and Biofoundry is being initiated in alignment with ‘Lifestyle for the Environment (LiFE)’.

| PYQ REFERENCE: (2015) Q. ‘BioCarbon Fund Initiative for Sustainable Forest Landscapes’ is managed by the (a) Asian Development Bank (b) International Monetary Fund (c) United Nations Environment Programme (d) World Bank |

Source: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2222079®=3&lang=1

4. Consider the following statements:

1. Article 262 of the Constitution empowers the President to adjudicate disputes relating to inter-State river waters.

2. Under the Inter-State River Water Disputes Act, 1956 tribunal decisions are final and binding on the states.

3. Though Article 262 bars jurisdiction of the Supreme Court, it can hear appeals under Article 136.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Answer: (b) 2 and 3 only

Explanation:

In NEWS: Supreme Court directs Centre to constitute tribunal to settle Pennaiyar river dispute between T.N. and Karnataka

| “262. Adjudication of disputes relating to waters of inter-State rivers or river valleys: (1) Parliament may by law provide for the adjudication of any dispute or complaint with respect to the use, distribution or control of the waters of, in any inter-State river or river valley. (2) Notwithstanding anything in this Constitution, Parliament may, by law, provide that neither the Supreme Court nor any other court shall exercise jurisdiction in respect of any such dispute or complaint as is referred to in clause (1)” [It should be noted that the “dispute” need not be between States, as such]. |

Constitutional Basis

- Article 262 of the Constitution empowers Parliament to:

- Adjudicate disputes relating to inter-State river waters. Hence statement 1 is incorrect.

- Exclude jurisdiction of the Supreme Court and other courts over such disputes.

Inter-State River Water Disputes Act, 1956 (ISRWD Act)

This is the primary legal mechanism.

Key features:

- A state can request the Union Government to intervene in a water dispute.

- If negotiations fail, the Centre may constitute a Water Disputes Tribunal.

- Tribunal decisions are final and binding on the states. Hence statement 2 is correct.

- Jurisdiction of courts is barred as per Article 262.

Examples of tribunals:

- Cauvery Water Disputes Tribunal

- Krishna Water Disputes Tribunal

- Ravi–Beas Tribunal

Inter-State River Water Disputes (Amendment) Act, 2002

- The tribunal must give a decision within 3 years (extendable by 2 years).

- Publication of tribunal awards in the Official Gazette makes it enforceable.

Institutional / Administrative Mechanisms

Negotiation and Mediation by the Union Government

- The Ministry of Jal Shakti facilitates talks between states.

- Used as a first step before tribunal formation.

Supreme Court’s Limited Role

- Though Article 262 bars jurisdiction, the Supreme Court:

- Can hear appeals under Article 136 (Special Leave Petition). Hence statement 3 is correct.

- Plays a role in interpretation and implementation of tribunal awards

(e.g., Cauvery dispute)

Federal and Cooperative Mechanisms

River Basin Management Authorities

- Created for implementation and regulation of tribunal awards.

- Example: Cauvery Water Management Authority (CWMA)

| PYQ REFERENCE: (2012) Q. Which of the following are included in the original jurisdiction of the Supreme Court? 1. A dispute between the Government of India and one or more States. 2. A dispute regarding elections to either House of the Parliament or that of Legislature of a State 3. A dispute between the Government of India and a Union Territory 4. A dispute between two or more States. Select the correct answer using the codes given below: (a) 1 and 2 only (b) 2 and 3 only (c) 1 and 4 only (d) 3 and 4 only |

5. With reference to Miniratna Category-I CPSEs, consider the following statements:

1. They must have made profits continuously for the last three years or earned a net profit of ₹30 crores or more in all the three years.

2. They are permitted to invest up to ₹500 crore or an amount equal to their net worth, whichever is lower.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer: (b) 2 only

Explanation:

In NEWS: Raksha Mantri approves grant of ‘Miniratna’ Category-I status to Yantra India Limited

Public Sector Undertakings:

- Public Sector Undertakings (PSU) in India are government-owned entities in which at least 51% of stake is under the ownership of the Government of India or state governments.

- These types of firms can also be a joint venture of multiple PSUs. These entities perform commercial functions on behalf of the government.

- Depending on the level of government ownership, PSUs are officially classified into two categories: Central Public Sector Undertakings (CPSUs), owned by the central government or other CPSUs; and State Public Sector Undertakings (SPSUs), owned by state governments.

- CPSU and SPSU are further classified into Strategic Sector and Non-Strategic Sector.

- Depending on their financial performance and progress, CPSUs are granted the status of Maharatna, Navaratna, and Miniratna (Category I and II).

Guidelines for awarding Ratna status are as follows:

| Category | Eligibility | Benefits for investment |

| Maharatna (transl. “Great Jewel” or “Mega Jewel”) | Three years with an average annual net profit of over ₹2,500 crores, OR The average annual Net worth of ₹10,000 crores for three years, OR Average annual Turnover of ₹20,000 crore for three years (against Rs 25,000 crore prescribed earlier) | ₹1,000 crore – ₹5,000 crores, or free to decide on investments up to 15% of their net worth in a project |

| Navaratna (transl. “Nine Jewels”) | A score of 60 (out of 100), based on six parameters which include net profit, net worth, total manpower cost, the total cost of production, cost of services, PBDIT (Profit Before Depreciation, Interest, and Taxes), capital employed, etc., AND A PSU must first be a Miniratna and have 4 independent directors on its board before it can be made a Navratna. | up to ₹1,000 crore or 15% of their net worth on a single project or 30% of their net worth in the whole year (not exceeding ₹1,000 crores). |

| Miniratna Category-I (transl. “Small Jewel” or “Mini Jewel” Category-I) | Have made profits continuously for the last three years or earned a net profit of ₹30 crores or more in one of the three years Hence statement 1 is incorrect. | up to ₹500 crore or equal to their net worth, whichever is lower. Hence statement 2 is correct. |

| Miniratna Category-II (transl. “Small Jewel” or “Mini Jewel” Category-II) | Have made profits continuously for the last three years and should have a positive net worth. | up to ₹300 crores or up to 50% of their net worth, whichever is lower. |

| PYQ REFERENCE: (2011) Q. Why is the Government of India disinvesting its equity in the Central Public Sector Enterprises (CPSEs)? 1. The Government intends to use the revenue earned from the disinvestment mainly to pay back the external debt. 2. The Government no longer intends to retain the management control of the CPSEs. Which of the statements given above is/ are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |

Source: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2222169®=3&lang=1

https://en.wikipedia.org/wiki/Public_Sector_Undertakings_in_India

6. The Yettinahole Project aims to divert water from streams that are tributaries of which river system?

(a) Cauvery

(b) Krishna

(c) Netravati

(d) Godavari

Answer: (c) Netravati

Explanation:

In NEWS: CAG flags serious irregularities in tendering, financial management of Yettinahole project

Yettinahole Project:

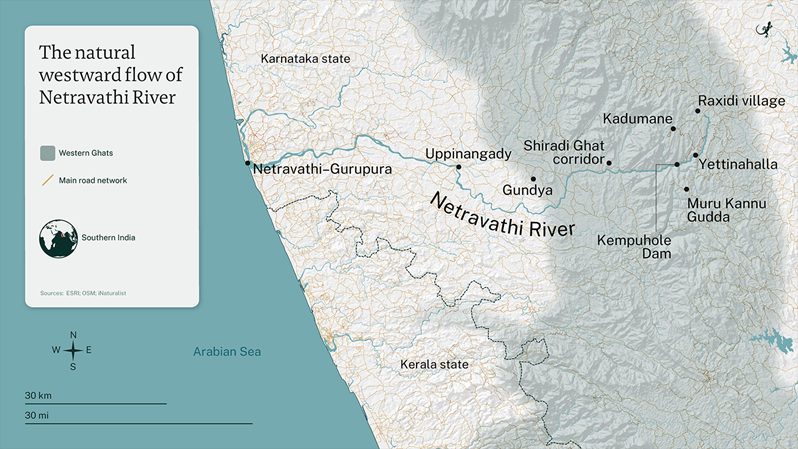

- The Yettinahole Integrated Drinking Water Project is implemented by the Karnataka government.

- It aims to supply drinking water to drought-prone districts in eastern Karnataka.

- The project draws its name from the Yettinahole stream, one of the headwater tributaries of the Netravathi River, originating in the Western Ghats near Sakleshpur in Hassan District. Hence option (c) is correct.

- The project plans to divert water from west-flowing streams in the Western Ghats, including Yettinahole, Kadumane Hole, Keri Hole, and Hongada Halla.

- The project will benefit over 75 lakh people across 7 districts and 6,657 villages and 38 towns.

- Total estimated cost has escalated to over ₹23,000 crore.

- The first phase (initial lifting and canals) has been inaugurated, full project expected by 2027.

| PYQ REFERENCE: (2001) Q. Consider the following information : S.no – Waterfall – Region – River 1. – Dhuandhar – Malwa – Narmada 2. – Hundru – Chota Nagpur – Subarnarekha 3. – Gersoppa – Western Ghats – Netravati In how many of the above rows is the given information correctly matched? (a) Only one (b) Only two (c) All three (d) None |

7. Which of the following statements best describes MICE tourism?

(a) Travel undertaken primarily for religious and pilgrimage purposes, focused on visiting sacred sites and participating in faith-based rituals and festivals.

(b) Tourism associated with sports tournaments and mega events, involving travel by athletes, officials, spectators and support staff for competitive sporting activities.

(c) Business-oriented travel involving organized meetings, incentive tours, conferences and exhibitions, aimed at networking and promotion of trade and professional collaboration.

(d) Tourism aimed at ecologically sensitive areas, emphasizing nature conservation, minimal environmental impact and sustainable interaction with local ecosystems.

Answer: (c) Business-oriented travel involving organized meetings, incentive tours, conferences and exhibitions, aimed at networking and promotion of trade and professional collaboration.

Explanation:

In NEWS: Promotion of MICE Tourism

MICE tourism:

- MICE is an acronym for Meetings, Incentives, Conferences and Exhibitions. The main purpose

- of MICE events is to create a networking platform for business, industry, government, and

- academic communities and engage in meaningful conversations. Generally, they bring large

- groups together for a specific purpose. MICE is also known as the ‘Meetings industry’ or

- ‘Events industry’. MICE is a sub-segment of business travel, but it can also involve a leisure component.

- MICE tourism (Meetings, Incentives, Conferences, Exhibitions) in India is a rapidly growing, high-revenue sector, leveraging improved infrastructure, diverse venues (from tech hubs like Bangalore to heritage cities like Jaipur), and government support like the “Meet in India” initiative to attract global business events, positioning India as a major player in the global MICE landscape.

Hence option (c) is correct.

Key Aspects of MICE Tourism in India:

- Growth Drivers: Post-liberalization economic growth, increased foreign investment, development of world-class convention centers, and government promotion.

- Infrastructure: Boasts numerous 5-star hotels, modern convention centers, and excellent connectivity, capable of hosting large international events, as shown by G20 meetings.

- Key Destinations: Major cities like Mumbai, Delhi, Bangalore, Hyderabad, and Chennai are established MICE hubs, while cities like Jaipur, Udaipur, and Kochi offer unique cultural backdrops.

- Economic Impact: High-spending delegates contribute significantly to GDP, boost employment, and drive investment in hospitality and related sectors.

- Government Initiatives: Programs like “Incredible India” and “Meet in India” actively market the country as a prime MICE destination.

Source: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2222138®=3&lang=1

8. Which of the following best describes the term ‘Orange Economy’, recently insisted in the union budget 2026?

(a) Economic activities related to agricultural value chains and food processing

(b) Sectors driven by creativity, culture, intellectual property, and digital content creation

(c) Industries focused on renewable energy and environmental sustainability

(d) Manufacturing activities based on high-technology and automation

Answer: (b) Sectors driven by creativity, culture, intellectual property, and digital content creation

Explanation:

In NEWS: Nirmala Sitharaman’s ‘orange economy’ bet: Turning gen Z hobbies into lucrative jobs

The 2026 Budget has quietly engineered a vibe shift for the GenZ, as it placed high stakes bets on the digital Orange Economy. While the headlines focus on macro-stability, the fine print reveals some good news for the Gen Z.

Orange Economy:

- The Orange Economy refers to economic activities based on creativity, culture, intellectual property, and digital content creation. Hence option (b) is correct.

- It includes sectors such as animation, gaming, films, music, design, fashion, digital media, advertising, and comics.

- The Orange Economy derives value primarily from ideas, creativity, and IP rights, rather than physical capital.

Orange Economy in India

- India’s Orange Economy is largely embedded within the services sector.

- India has a demographic advantage for the Orange Economy due to its large youth population and digital adoption.

- The AVGC sector is a key pillar of India’s Orange Economy.

- AVGC stands for Animation, Visual Effects, Gaming and Comics.

- India is one of the world’s largest consumers of digital content, strengthening domestic demand for the Orange Economy.

Policy & Institutional Support

- The Union Budget 2026 formally identified the Orange Economy as a driver of future services growth.

- Budget 2026 proposed the establishment of AVGC Content Creator Labs in schools and colleges.

- These labs will be anchored by the Indian Institute of Creative Technologies (IICT).

- The policy focus aims to integrate creative skills with formal education systems.

- The Orange Economy aligns with the government’s emphasis on youth-centric and first-job creation.

Economic & Strategic Significance

- The Orange Economy contributes to export of services and soft power projection.

- Creative industries strengthen India’s cultural diplomacy and global branding.

- The Orange Economy has relatively low entry barriers compared to heavy manufacturing.

- Digital platforms enable Indian creators to access global markets without physical relocation.

Employment & Skilling

- The AVGC sector in India is projected to require around 2 million skilled professionals by 2030.

- The Orange Economy supports freelance, gig, and platform-based employment models.

- Skill requirements emphasise digital literacy, storytelling, design, and AI-assisted creativity.

| PYQ REFERENCE: (2025) Q. Consider the following statements: Statement I: Circular economy reduces the emissions of greenhouse gases. Statement II: Circular economy reduces the use of raw materials as inputs. Statement III: Circular economy reduces wastage in the production process. Which one of the following is correct in respect of the above statements? (a) Both Statement II and Statement III are correct and both of them explain Statement I (b) Both Statement II and Statement III are correct but only one of them explains Statement I (c) Only one of the Statements II and III is correct and that explains Statement I (d) Neither Statement II nor Statement III is correct |

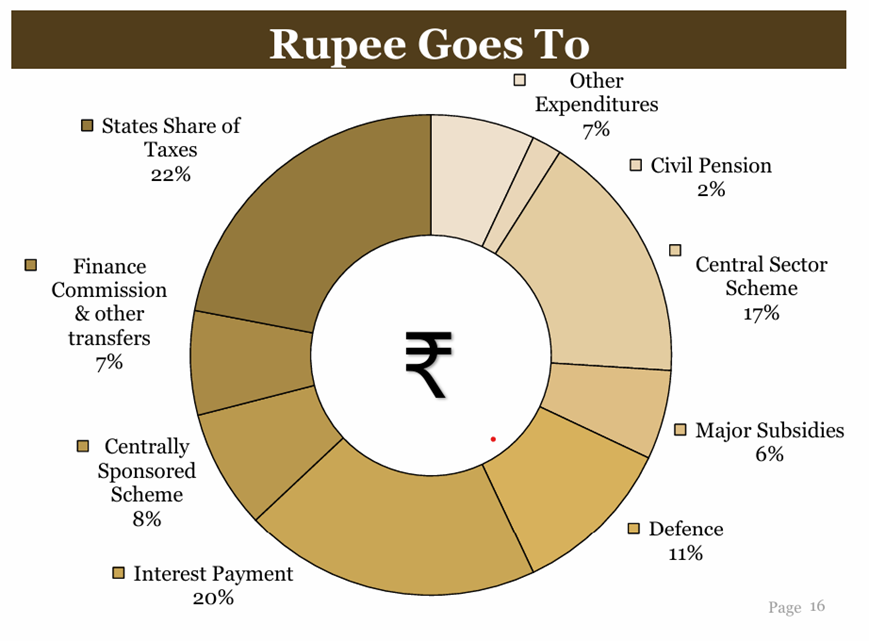

9. Consider the following statements:

1. Non-Debt Capital Receipts

2. Union Excise Duties

3. Civil Pension

4. Central Sector Scheme

5. Major Subsidies

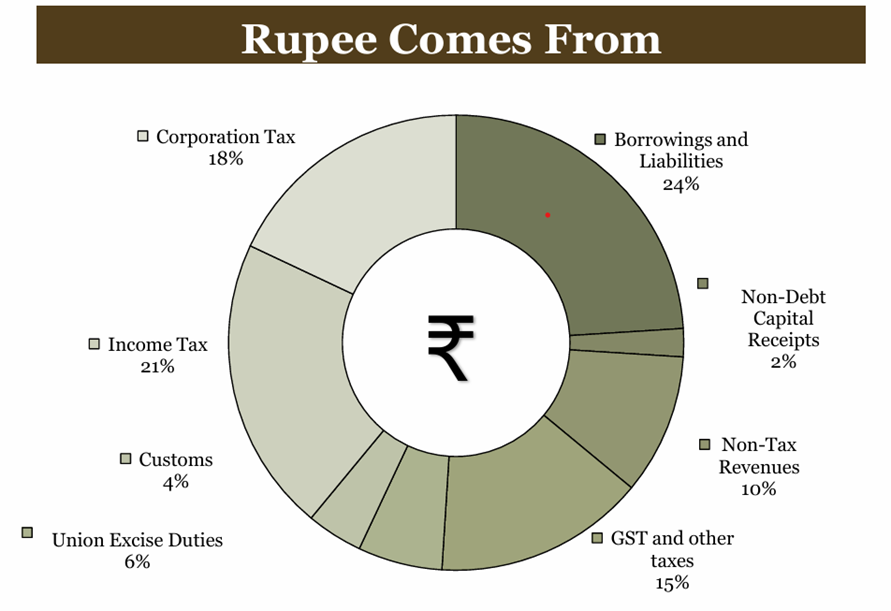

How many of the above are the source of income for the government that rupees comes from?

(a) Only two

(b) Only three

(c) Only four

(d) All five

Answer: (a) Only two

Explanation:

In NEWS: Union Budget – 2026

Hence 1 and 2 are correct.

| PYQ REFERENCE: (2025) Q. Which of the following are the sources of income for the Reserve Bank of India? I. Buying and selling Government bonds II. Buying and selling foreign currency III. Pension fund management IV. Lending to private companies V. Printing and distributing currency notes Select the correct answer using the code given below. (a) I and II only (b) II, III and IV (c) I, III, IV and V (d) I, II and V |

Source: The Hindu

10. Fa-hien (Faxian), the Chinese pilgrim, travelled to India during the reign of

(a) Samudragupta

(b) Chandragupta II

(c) Kumaragupta I

(d) Skandagupta

Answer: (b) Chandragupta II

Explanation:

- Fa-hien (Faxian), the Chinese Buddhist pilgrim, traveled to India during the reign of Chandragupta II (also known as Vikramaditya) of the Gupta dynasty. Hence option (b) is correct.

- He arrived in India around 399 CE and remained until 412 CE, leaving detailed records of the Gupta empire’s prosperity, social life, and Buddhism.

- He visited the sacred Buddhist sites and collected authentic Buddhist manuscripts.

- His records stated a peaceful and well-administered empire, praising the reign of Chandragupta II.